As businesses navigate constant change, they face the dual challenge of staying agile and making well-informed decisions that drive growth. With markets constantly shifting and technological advancements providing new tools, businesses need to rely on accurate, real-time data to guide their strategies. Enter NetSuite ERP – a robust cloud-based solution that empowers organizations to embrace data-driven decision making, ensuring they remain competitive and efficient.

NetSuite ERP’s powerful real-time analytics and dashboard features offer businesses the insights they need to make informed decisions quickly. With its tools designed for everything from financial reporting to operational efficiency, NetSuite enables organizations to harness the full potential of data, transforming raw information into strategic advantage.

The Importance of Data-Driven Decision Making

Data-driven decision making is no longer optional for modern businesses; it is a necessity. Organizations that fail to leverage data effectively risk falling behind in an increasingly competitive landscape. By integrating real-time data into their decision-making processes, businesses can respond quickly to changes in customer behavior, market dynamics, and operational challenges. NetSuite ERP’s built-in analytics tools allow businesses to access the critical data needed to make informed decisions that can propel their success.

A recent report revealed that 91% of companies believe data-driven decision-making is crucial for business growth. However, despite this recognition, only 57% of companies actually rely on data to guide their business decisions. The disparity highlights the untapped potential for growth that businesses can unlock by leveraging data more effectively.

Data-driven decision making offers numerous benefits, including:

Informed Risk Assessment: With access to real-time data, businesses can identify potential risks early and take proactive steps to mitigate them. By relying on data to inform their decisions, companies can avoid costly mistakes that might otherwise go unnoticed. For example, if a business sees early indicators of a supplier shortage or rising costs, it can take steps to diversify its supply chain or renegotiate terms, avoiding disruptions.

Enhanced Accuracy: Data-driven decision making eliminates the reliance on intuition or guesswork, ensuring that decisions are based on actual, up-to-date data that reflects current business conditions. This accuracy helps businesses avoid missteps and make smarter choices. For instance, rather than making strategic decisions based on quarterly reports that might be outdated, businesses using real-time data can adjust their plans daily, reacting to shifts in the market promptly.

Faster Decision-Making: With access to real-time data, decision makers can act quickly, reducing the time spent gathering information and enabling businesses to respond more rapidly to emerging opportunities or challenges. This speed is essential in industries like retail or manufacturing, where demand patterns can shift rapidly.

Improved Resource Allocation: Data analytics allows businesses to allocate resources more efficiently, ensuring that investments are directed toward the areas that will yield the highest returns, whether in terms of revenue, productivity, or customer satisfaction. For example, a company can use NetSuite’s analytics to identify which products or services are underperforming, reallocating resources to focus on the best-performing offerings.

Continuous Improvement: By regularly reviewing data insights, companies can continuously refine their strategies, optimize processes, and foster a culture of innovation and improvement. NetSuite ERP supports a feedback loop where businesses can analyze past decisions to understand what worked, what didn’t, and why.

NetSuite ERP’s dashboard analytics are designed to provide leaders with at-a-glance visibility into key performance indicators (KPIs), ensuring that decision-makers have the most relevant data available at all times. This real-time insight empowers businesses to make quick adjustments that can improve both operational efficiency and overall strategy.

Real-Time Data Analytics for Strategic Advantage

Real-time data analytics offers businesses a strategic edge, enabling them to stay ahead of the competition. NetSuite ERP’s comprehensive data analytics tools allow companies to monitor various aspects of their business – from inventory levels to financial performance – ensuring that all teams are aligned and informed.

One of the standout features of NetSuite ERP is its ability to deliver real-time data on financial performance. Financial teams can generate detailed reports at a moment’s notice, allowing for more timely and accurate decisions. This can be particularly valuable when making decisions related to budgeting, cash flow, and profitability. With NetSuite, businesses can access profit-and-loss statements in real time, helping to immediately assess whether they are on track to meet financial goals.

Beyond internal operational benefits, real-time data analytics also plays a significant role in enhancing customer relationships. By analyzing customer trends, purchasing behavior, and market demands, companies can personalize their offerings, ensuring that they meet the ever-changing needs of their target audience. For example, a retailer using NetSuite’s CRM features can track customer buying habits and tailor promotions, improving conversion rates and customer loyalty. Real-time data empowers businesses to develop strategies that cater specifically to customer preferences, fostering loyalty and increasing satisfaction.

Enhancing Operational Efficiency through NetSuite ERP

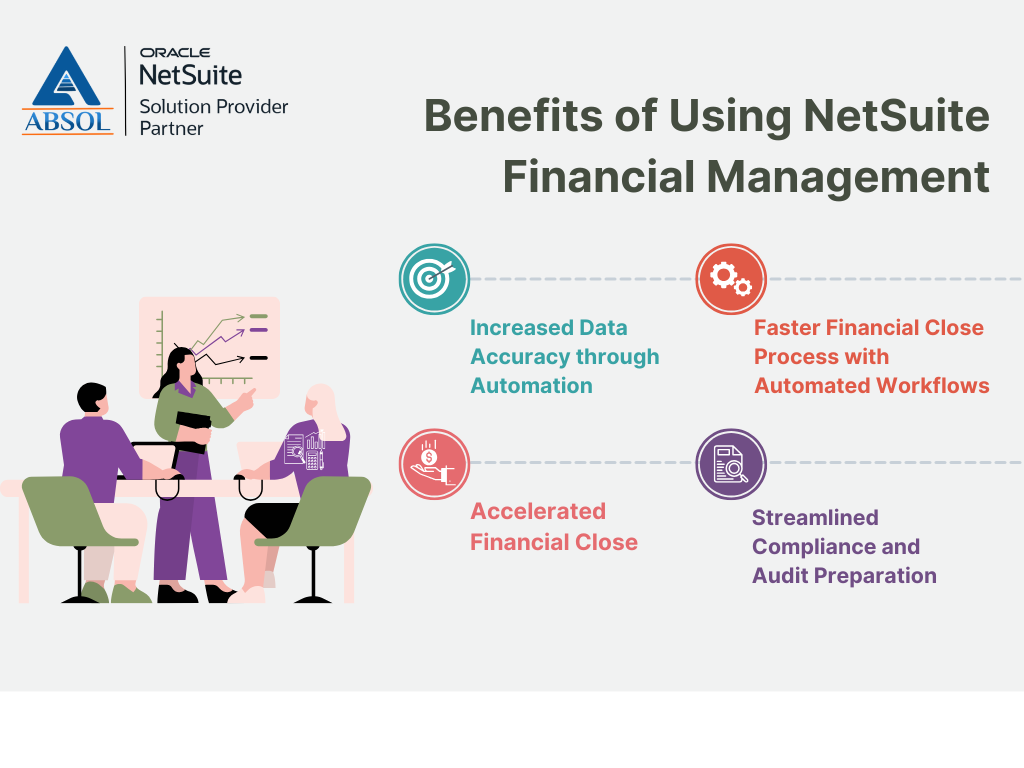

In any organization, operational efficiency is directly tied to profitability. Streamlining processes, reducing manual errors, and ensuring that teams are working collaboratively can help organizations maximize their output and reduce waste. NetSuite ERP offers a suite of automation tools that allow businesses to automate repetitive tasks and free up valuable time and resources.

Business process automation is a key component of NetSuite ERP, covering a wide range of functions, from payroll to invoicing and inventory tracking. By automating these processes, businesses can reduce the risk of human error, improve accuracy, and ensure that essential tasks are completed promptly. For example, automated invoicing reduces the chances of billing errors, speeding up the accounts receivable cycle and improving cash flow.

A 2023 report found that 66% of organizations have experienced increased operational efficiency through their ERP systems. The ability to streamline workflows, reduce redundancies, and automate routine tasks has had a significant impact on how businesses operate, ultimately leading to better results. The automated workflow ensures that employees focus on more value-added tasks, enhancing productivity and contributing to organizational growth.

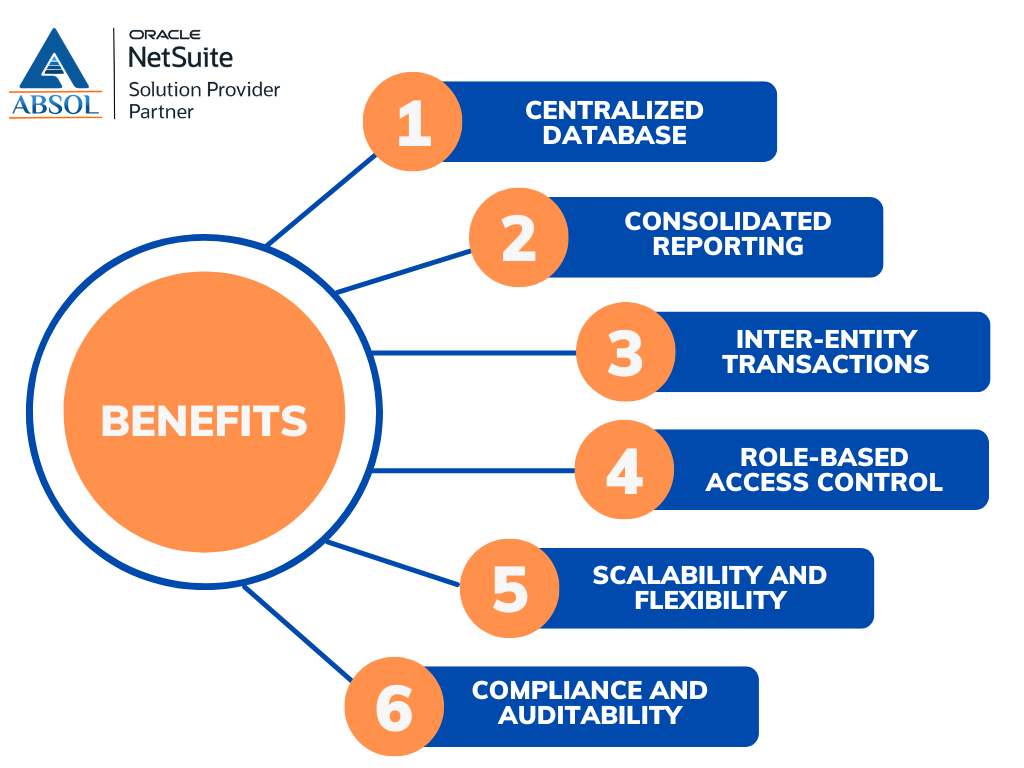

Moreover, NetSuite ERP integrates data from across departments, providing a centralized system that connects various business functions. This seamless flow of data reduces communication gaps and promotes collaboration across teams. With improved coordination and streamlined operations, businesses are better positioned to innovate and achieve sustainable growth.

Financial Reporting Made Easy

Accurate and timely financial reporting is essential for businesses looking to maintain transparency, compliance, and operational control. NetSuite ERP simplifies financial reporting by automating the generation of comprehensive financial statements and reports, ensuring that businesses can meet regulatory requirements and internal reporting deadlines.

The cloud-based nature of NetSuite ERP also enables users to access up-to-date financial data at any time, ensuring that the reports are always accurate and relevant. This real-time access helps businesses stay on top of their financial health, enabling leaders to make timely decisions that align with their strategic goals.

For CFOs and finance teams, the ability to track revenue, expenses, and profitability in real-time is crucial for optimizing financial strategies. With NetSuite ERP, businesses can track key financial metrics such as gross margin, operating income, and cash flow, empowering decision-makers with the tools needed to drive growth and profitability. With more accurate financial reporting, companies can improve their creditworthiness, enhance investor relations, and make better financial forecasts.

NetSuite’s advanced reporting capabilities extend to multi-currency support, making it an excellent choice for businesses with international operations. It ensures that financial data is accurate across different regions, streamlining financial reporting for multinational companies.

Customization with Industry-Specific Solutions

One of the standout features of NetSuite ERP is its flexibility to cater to various industries. No two industries are the same, and businesses in sectors such as manufacturing, retail, healthcare, and services require solutions tailored to their specific needs. NetSuite ERP offers customizable solutions designed to align with industry standards, ensuring that companies in any field can benefit from the platform’s powerful capabilities.

Industry-specific solutions come equipped with pre-built dashboards, workflows, and reporting tools that are specifically designed to address the unique needs of each sector. For example, manufacturers can track production metrics and analyze supply chain data, while retail businesses can assess customer purchase patterns to optimize sales strategies. Customizing NetSuite for your industry ensures that you’re not wasting time with irrelevant features or complex configurations.

These tailored solutions help companies leverage data-driven insights that are relevant to their industry, providing them with a competitive advantage in their respective markets. NetSuite’s industry-centric approach reduces the need for additional software or plugins, streamlining operations and cutting down on unnecessary costs.

Strategic Decision Making with Dashboard Analytics

NetSuite ERP’s dashboard analytics provide an invaluable tool for decision-making. By offering real-time visibility into various business functions, dashboards enable leaders to view critical KPIs in a centralized format. This allows managers and executives to make quick decisions based on the most relevant data.

By monitoring sales performance, employee productivity, customer trends, and other key metrics, businesses can quickly identify areas that need attention or improvement. This empowers decision-makers to take immediate action, ensuring that strategies are adjusted based on real-time data insights.

NetSuite’s customizable dashboards can be tailored to the specific needs of each department or team, ensuring that everyone has access to the information they need to make informed decisions. With these dashboards, businesses can stay agile, pivoting their strategies as needed to adapt to changing market conditions.

The simplicity and clarity of NetSuite’s dashboard analytics improve decision-making across departments. Whether you’re in sales, operations, or finance, having a tailored dashboard ensures you are working with the most relevant data for your role.

Empowering Data-Driven Analytics with NetSuite ERP

The integration of data-driven analytics directly into NetSuite ERP creates a seamless experience for decision-makers. The system collects data across multiple touchpoints within an organization, transforming it into valuable insights that drive business success. Whether you are managing finances, sales, or inventory, NetSuite’s real-time analytics allow businesses to remain agile and make more informed decisions.

By leveraging NetSuite’s data-driven insights, companies can enhance decision-making, optimize operations, improve profitability, and drive growth. Whether it’s identifying market trends, customer behavior, or internal inefficiencies, NetSuite ensures that decision-makers have access to the data they need to succeed.

Additionally, the power of NetSuite’s embedded analytics extends beyond traditional reporting. With customizable dashboards and interactive visualizations, businesses can easily monitor key performance indicators (KPIs), track progress toward goals, and pinpoint areas for improvement. This level of accessibility empowers stakeholders at all levels of the organization to make data-backed decisions that align with long-term strategic objectives. By breaking down data silos and ensuring that insights are readily available across departments, NetSuite fosters a collaborative, data-driven culture that supports continuous improvement and innovation.

Business Process Automation: Reducing Manual Work and Errors

Automating routine tasks through NetSuite ERP saves time and minimizes manual errors. The system’s automation features are designed to handle tasks ranging from billing to payroll processing, freeing employees to focus on strategic initiatives that contribute to business growth.

NetSuite’s cloud ERP solution is highly scalable, making it ideal for companies of any size. As businesses expand, they often encounter the challenge of managing increasing data volumes. By automating data entry and eliminating redundant tasks, NetSuite ERP’s business process automation maintains efficiency, regardless of company size or complexity.

Business process automation in NetSuite ERP enables organizations to streamline workflows, thereby reducing bottlenecks and enhancing productivity. Automated tasks reduce the need for constant manual oversight, allowing teams to concentrate on innovation and strategic planning.

Harnessing Data Insights for Competitive Advantage

In a dynamic marketplace, data insights are key to staying competitive. NetSuite ERP empowers businesses with real-time analytics that reveal trends and patterns, helping leaders make informed, strategic choices. With NetSuite, users can explore specific data points, uncover hidden opportunities, and respond proactively to changing conditions.

Real-time data integration within NetSuite ERP also strengthens a company’s understanding of its customers, enabling targeted marketing and personalized service. By leveraging these insights, businesses can create customer-centered strategies that enhance satisfaction and build long-term loyalty.

Furthermore, NetSuite’s data-driven capabilities provide a comprehensive view of market dynamics, enabling companies to track competitor performance, anticipate industry shifts, and refine their positioning. By utilizing advanced analytics, organizations can identify emerging trends and adjust their strategies accordingly, gaining a competitive edge. This proactive approach helps businesses stay ahead of the curve, ensuring they remain relevant and adaptable in an ever-evolving market landscape.

The Future of Decision-Making with NetSuite ERP

As digital transformation continues to reshape industries, the demand for advanced cloud ERP solutions like NetSuite ERP is on the rise. NetSuite ERP’s capability to support data-driven strategies ensures that organizations remain agile, resilient, and forward-thinking. By embedding data-driven insights into decision-making processes, NetSuite ERP provides the tools needed for sustained growth and adaptability.

Incorporating real-time data analytics, customizable dashboards, and robust automation, NetSuite ERP equips businesses with a comprehensive ERP solution that empowers them to respond to challenges with confidence. As a scalable platform, NetSuite ERP adapts to evolving needs, helping businesses to thrive in an ever-changing environment.

NetSuite ERP will continue to evolve with emerging technologies such as artificial intelligence (AI) and machine learning (ML), further enhancing decision-making capabilities. These technologies enable predictive analytics, providing organizations with foresight into potential risks and opportunities before they arise. By integrating AI and ML into its platform, NetSuite ERP will not only automate repetitive tasks but also offer deeper insights into future trends, enabling businesses to make proactive decisions that drive long-term success.

Conclusion

In an increasingly data-driven world, the ability to make informed decisions is critical for business success. NetSuite ERP empowers organizations by providing real-time data analytics, customizable dashboards, and predictive capabilities that drive smarter, faster decision-making. By centralizing data, streamlining operations, and enhancing collaboration, NetSuite ensures that businesses can remain agile, competitive, and efficient in an ever-changing marketplace.

Whether it’s improving operational performance, enhancing customer experience, or optimizing financial forecasting, NetSuite offers businesses the tools they need to leverage data for strategic advantage. With its robust set of features and seamless integration across departments, NetSuite ERP transforms raw data into actionable insights, enabling organizations to make data-driven decisions that drive growth, profitability, and long-term success.

Ready to take the next step in data-driven decision making? Contact ABSOL today to learn how NetSuite ERP can empower your business to thrive with real-time data, automation, and industry-specific solutions. Start transforming your operations with NetSuite ERP now!